SUMMARY

We’re starting to see some real warning signs in the housing data coming out of North Carolina. A lot of the downward pressure on price levels in the market has to do with the rising inventory levels of housing. As of June of this year, the inventory level of housing available for sale across the state is more than triple what it was in 2022. When you look at inventory, it’s just basic supply and demand. As supply rises and if demand stays the same, we know that eventually prices are inclined to fall.

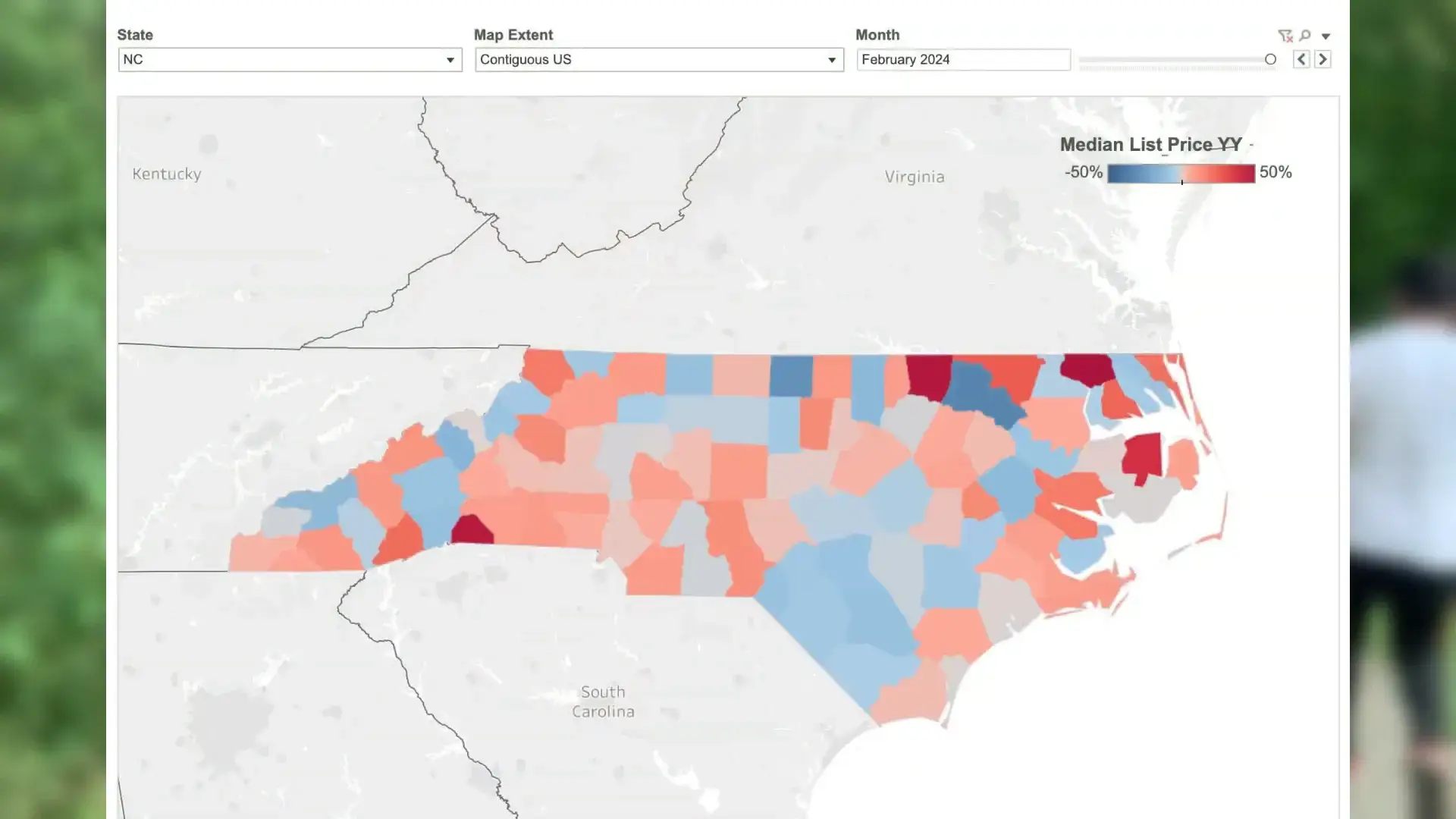

Median list prices for housing are actually declining. This is after several years where prices were rising in spite of the rising inventory. The existing inventory coming to market needs to be marked down. The listing data is a little more forward-looking; you can predict what the sales data will be in 2 or 3 months. If you want to see where this trend is headed, look at some of these rural markets in eastern North Carolina outside of Raleigh, where median list prices have declined between 3 and 7% in various counties.

Despite the price declines, there are fewer transactions in the housing market statewide. The year-over-year data shows that fewer transactions were completed this year than in June of last year. Buyers just aren’t getting enough value, and this trend has a lot longer to run. The price drops are just getting started.

We’re starting to see some of the weakness in the housing market spill over into the land market as well. The last 10 tracks of vacant land sold in Harnett County averaged 166 days on the market, selling at an average discount to asking price of 15.9%. Seven out of the last ten transactions were marked down significantly, with one marked down over 50%.

You have approximately 12 months of inventory in the land market right now. While that doesn’t sound too bad, remember this is the prime sales season. As we move into the fall, days on the market will go way up for both land and homes. If you seasonally adjust this data, we’re probably looking at something closer to 14 to 18 months of inventory in the land market.

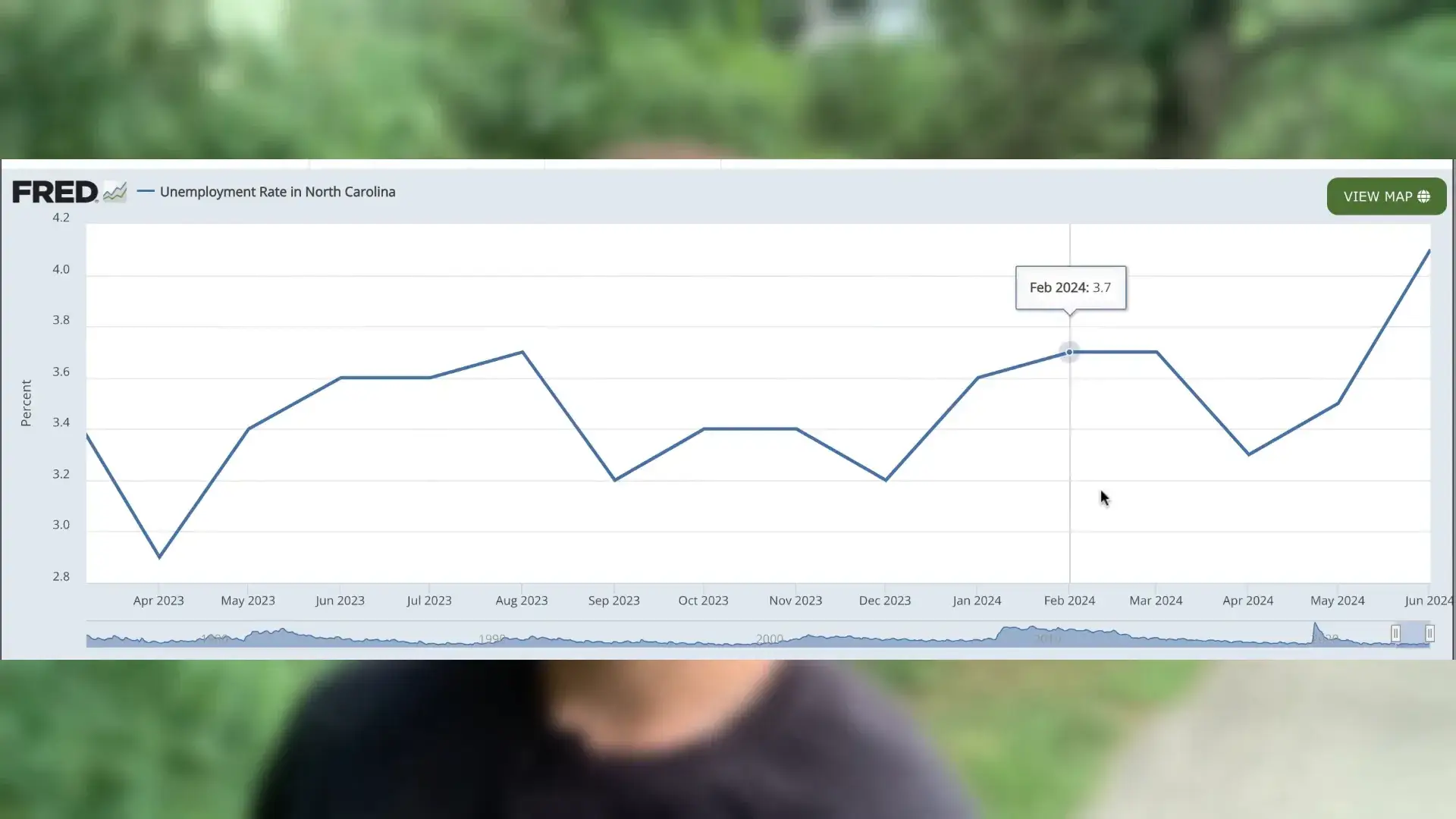

In addition, North Carolina is seeing rising unemployment from the low in April 2023. The unemployment rate has increased by 40% in just 14 months. This is one of the most reliable indicators of market cycles. What we’re seeing is a reversal of the long-term trend in the labor market.

Historically, when the unemployment rate starts to reverse direction, a recession is usually around the corner. This trend has been observed in the past two recessions. The unemployment rate peaked in 2011, which was the very bottom of the real estate market.

As the unemployment rate increases, it means that many people are being laid off, losing jobs, or being relocated. There are homeowners who bought properties in the past couple of years that may now need to sell. If they do, they might find that they have little equity because they bought at high prices.

This situation creates a lot of stress in the housing market that will likely continue. People will find that their equity is not in their homes but in their land. The rising inventory in the housing market is mirrored by the rising inventory in the land market. We will see a slowdown in transaction volume in the land market as buyers have less disposable income and interest rates are higher.

As the inventory of housing and land rises, we are in a historical context where the value of housing is extremely high by historical standards. The median home price to income ratio is at an all-time high, which is a well-studied indicator of market cycles and housing affordability.

As prices start to fall, there will be momentum because there is nothing but air under these housing numbers. The short-lived benefits of falling interest rates and artificially low rates won’t hold up for long. What drives the housing market is not interest rates, but supply and demand. When interest rates cut, it often signifies economic weakness.

This market isn’t the time to be complacent. It’s essential to do your homework and stay informed about the trends in the housing market. Share this information with friends or colleagues who might benefit from it, and leave a comment if you have thoughts to share.